Why Tax-Exempt Groups are a Political Minefield for the IRS

The IRS stumbled into a political minefield when it targeted tax-exempt groups.

May 16, 2013 — -- To be sure, tax-exemption is one perk of receiving 501(c)4 status from the IRS, but the real reason the tax-exempt status has in recent years become a popular vehicle for groups that straddle the line between advocacy and politics is that the status allows them to do political work and keep their contributions hidden.

Ever since the 2010 Citizens United v. Federal Election Commission Supreme Court ruling allowed corporations and unions to spend unlimited amounts of money in political elections as long as they didn't coordinate their activities with campaigns or donate directly to candidates, groups seeking to influence elections but not disclose their donors have flocked to tax-exempt 501(c)4 organizations. The IRS said that applications for tax-exempt status shot up from 1,751 in 2009 to 3,357 in 2012.

Read more about the IRS controversy HERE.

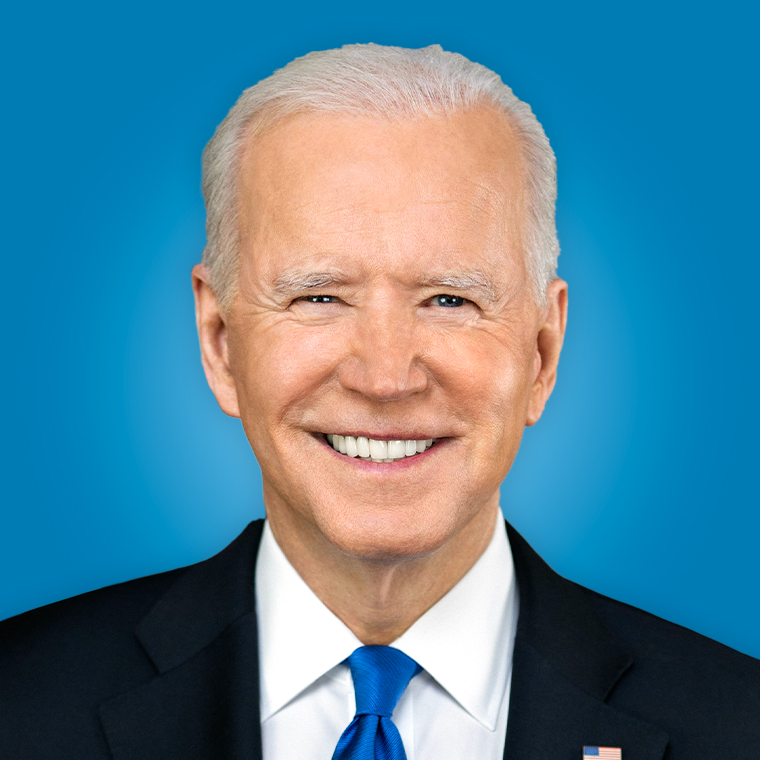

And Democrats – including President Obama – have claimed since then that the ruling opened the door to special interests buying political elections.

"With its ruling today, the Supreme Court has given a green light to a new stampede of special interest money in our politics," Obama said in a statement following the court decision in 2010. "It is a major victory for big oil, Wall Street banks, health insurance companies and the other powerful interests that marshal their power every day in Washington to drown out the voices of everyday Americans."

Republicans, on the other hand, say that the ability to participate in elections by donating money, without having their names exposed publicly, is part of the constitutional right to free speech.

To conservatives, the IRS's scrutiny of groups according to their names and mission statements between 2010 and 2012 put the weight of its enforcement power on the Democrats' side of the ledger.

"I think that if you look at the IRS scandal, we see that the left will stop at nothing to thwart the conservative movement and try to freeze and really intimidate people from political speech," said David Bossie, president of the conservative 501(c)4 Citizens United.

The irony is that the IRS's dragnet, which was intended to catch groups that might have been too engaged in political activity, hasn't stopped the largest of these groups from exerting influence in the political sphere.

Two of the most influential 501(c)4s, Crossroads GPS, founded by Republican political operative Karl Rove, and Priorities USA, which was founded by former aides to President Obama, have been operating as nonprofits without disclosing their donors even though the IRS has yet to rule on their applications for 501(c)4 status.

Former IRS Commissioner Doug Shulman told Congress last year that applying for tax-exempt status was strictly voluntary. Any group can claim that it is a tax-exempt 501(c)4 organization so long as it later files tax disclosures.

If the IRS encounters problems, it can investigate at a later date.

"First of all, I think it's very important to emphasize that all of these organizations came in voluntarily. They did not need to engage the IRS in a back-and-forth," Shulman told Congress when asked about delayed action on applications from conservative groups. "They could have held themselves out, filed a 990, and if we had seen an issue, we would have engaged, but otherwise we wouldn't."